Earnings above expectations. 1H10 net profit of $4.2m was slightly better than our net profit forecast of S$4m due to better-than-expected sales, associates contribution and lower-than expected effective tax rate.

Earnings above expectations. 1H10 net profit of $4.2m was slightly better than our net profit forecast of S$4m due to better-than-expected sales, associates contribution and lower-than expected effective tax rate.

However, this was slightly offset by lower-than-expected gross profit margins.

Sales surged 368% yoy or 39% hoh to S$36.6m as all business activities started recovering from the global economic crisis. Despite the sales mainly contributed from semiconductor segment, the successful diversifation of its Medical and ECO divisions have pushed its sales to a record high for a six-month period.

Gross margins expanded by 3.2% pts yoy to 21.5%, due to higher contribution from manufacturing segment which commands higher gross margins. However, EBITDA margins reversed from negative yoy or increased 3.9% pts hoh to 12%, due to better economies of scale and cost control.

Together with lower depreciation, financial cost and income tax, net loss reversed from S$0.9m to a net profit of S$4.2m yoy.

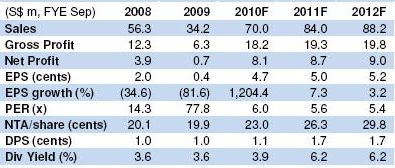

Source: NRA Capital

Including a total S$6m dividend payout and share buy-back, net cash reduced slightly to S$12.9m as at end-Mar 10 from S$15m in FY09.

Order remains firm and yet not over stocking. North America-based manufacturers of semiconductor equipment posted US$1.29 bn in orders in Mar 10 and a book-to-bill ratio of 1.19, according to SEMI. A book-to-bill of 1.19 means that $119 worth of orders was received for every $100 of product billed for the month.

Its low inventory level indicates there is no overstocking at this moment. We also understand from management that it is hard for them to increase the stock level from now as supply is still tight.

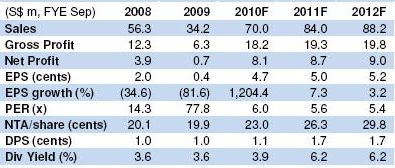

Raising target price from S$0.37 to S$0.40; maintain BUY. Given the group traditionally enjoys a seasonally stronger 2H as compared to 1H, we have reviewed our 2H net profit forecasts from declining 20% hoh to decline 7% hoh.

Our FY10, FY11 and FY12 earnings increased by 11%, 8% and 8%, respectively. Also, our fair value has been raise from S$0.37 to S$0.40, still pegged at 8x PER FY09/11. Maintain our BUY call.

Earnings above expectations. 1H10 net profit of $4.2m was slightly better than our net profit forecast of S$4m due to better-than-expected sales, associates contribution and lower-than expected effective tax rate.

Earnings above expectations. 1H10 net profit of $4.2m was slightly better than our net profit forecast of S$4m due to better-than-expected sales, associates contribution and lower-than expected effective tax rate.

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors