Venue: Serial System Building, 5, Ubi View

Venue: Serial System Building, 5, Ubi View

Time & Date: 10.30 am, Apr 24.

STOCK OPTIONS issued to employees can dilute the equity holding of shareholders - and that's what was on the back of a Serial System shareholder's mind when a resolution on the issue of stock options came up at the AGM.

As in 2008, a resolution tabled at Serial System’s AGM this year sought shareholder approval for the issue of stock options to key employees.

A shareholder queried the discount that the share options would be issued at.

Robson Lee, the company’s non-executive independent director, replied: “It may be up to 20%, which is in compliance with the listing rules. But Serial has not issued options for many years - it is something we would consider very carefully, looking at the impact of the dilution on the shareholding of shareholders.”

Derek Goh, chairman and CEO of Serial System, who owns a 36% stake in Serial, added: “If we have to issue stock options, we will - as an extra incentive to key staff. Whatever I give will dilute me too. Every $1 I give, 36 cents come from me. And I, as a major shareholder, don’t get a single stock option – even after 22 years of working for this company.”

Serial System’s FY09 annual report lists the stock options given in past years, with the last date of grant being July 2003.

In a presentation on Serial’s business and prospects to the AGM attendees, Mr Goh said the company would pay 40-50% of its net profit as dividends. Accordingly, in 2008 and 2009, the dividends declared were 0.58 cent and 0.51 cent a share, respectively.

Based on a recent stock price of 11 cents, the dividend yield for FY09 would be 4.6% (ie, 0.51 divided by 11).

The dividend payout for FY10 would be higher if the company’s profit surges.

Already, in 1Q, its net profit was $2.9 million, up 314% from 1Q of last year on a strong recovery of the semiconductor industry.

Here are some highlights from the Q&A session:

Q: Last year, your South and Southeast Asia markets declined by 21% because they were were heavily dependent on exports to the US and Europe. Have the South and Southeast markets recovered?

Mr Goh: Defiinitely, we have recovered. Some markets are more focused on EMS (electronics manufacturing services), like Venture Corporation, which manufacture for big MNCs. When the economy crashed, all the EMS companies produced a lot less. Now the economies are back and everyday, our customers are chasing us for products.

Q: How tough is it for new competitors to emerge in your industry?

Mr Goh: Nowadays, things are different from 22 years ago when I started Serial with $100,000. Now, even if you have $10 million, you will have difficulty to survive. The market is consolidating. The distributors have a few hundred million dollars. Those that have $30-50 million – let me tell you, their time is coming.

Technology changes rapidly, and you have to invest. If you are a small company, you cannot afford that.

And the suppliers are asking: ‘Why do I want to deal with so many ‘kacang puteh’ companies?” They have to employ more people – which is a fixed cost.

Q: How did you manage to gain market share in 2008 and 2009?

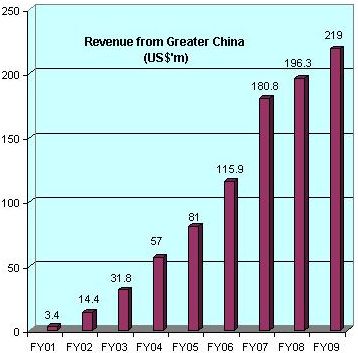

Mr Goh: It’s because of our extensive network we are able to get close to our customers. We increased our product lines. Some product lines that were maybe in Southeast Asia only, we expanded them to Taiwan or Korea or China. We also got new agencies. That’s why you see the growth.

Q: Your 1Q results were impressive. Going forward, what is your book to bill ratio?

Mr Goh: Quite high but there is a shortage of components, so customers are overbooking. If they need $100K and they tell suppliers they need $100K, they may get 10%. So they may order $500K, and then they get $50K. I expect the tightness to ease maybe in Q4 this year.

Recent story: SERIAL SYSTEM: Sterling $2.9 m profit in 1Q on semicon rebound