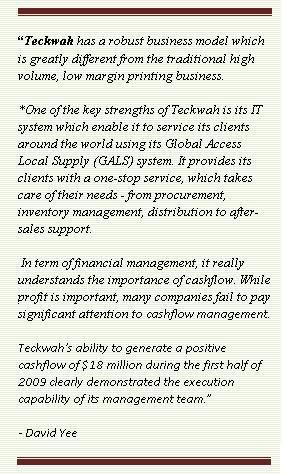

TO INVESTOR David Yee, when a company has $40 million cash on hand, 0.01% gearing and a market capitalization of $54 million, it’s time to buy the stock.

Teckwah Group is a company that fits the bill. It even has a net asset value (of about 39 cents/share) that is far higher than its stock price (23 cents).

David started a thread on Teckwah on the NextInsight forum about three months ago after the company announced its half-year results. His forum posting caught our attention and we decided to contact Teckwah for a chat.

The management kindly obliged and the meeting, which David joined, took place recently at its office in Pandan Crescent. We came away with greater clarity on the business.

Here are some interesting points about this unusual but conservatively-run business whose IPO was a long time ago - in 1994, to be precise:

|

|||||||||||||

1. IT hardware, business software, games software

Prior to the meeting, we had the impression that Teckwah (www.teckwah.com.sg) was into printing magazines and beautiful carton boxes for all sorts of products. Low-tech stuff.

But it turned out that some 70% of Teckwah’s revenue comes from the IT sector.

Unlike other printers which emphasise on business volume in printing, Teckwah focuses on offering a whole suite of services in the supply chain.

These services start from the moment it receives a CD-ROM Gold Master, for example, through to printing the packaging and instruction booklet , managing the inventory - and delivering the packed boxes to retailers.

(The Gold Master is the master copy for the CD replicator to produce copies of. Teckwah doesn't replicate CDs but works with partners.)

The packing and other services are carried out from Teckwah's plants in eight countries, including Singapore, Malaysia, Indonesia, China and Australia.

A recovery in the IT hardware sales (such as laptops and servers) and the introduction of new software (such as Windows 7 and anti-viral solutions) spell interesting business opportunities for Teckwah.

The bulk of the remaining contribution to Teckwah's revenue comes from the pharmaceutical sector.

That's it - Teckwah is focused on just IT and pharma customers.

Its services related to the printing and packaging contribute about 80% of the revenue, with the remaining coming from downstream value-add services such as reverse logistics and fourth-party logistics.

2. Seasonal business pattern 40-60:

Teckwah’s business in recent years was about 40% in the first half, and 60% in the second half, typically because of a rise in consumer sales of IT products - such as game software - during the year-end season.

But we have no clue whether this pattern will hold this year. In August, in its half-year results announcement, the company had said: “There are still uncertainties ahead.”

Teckwah made $5.1 million in net profit in the first half of this year, or 2.2 cents per share.

The $5.1 million profit was a 163% jump over the previous corresponding period. If it maintains that level of profitability, this year's EPS would be 4.4 cents per share.

The PE ratio would be 5.2X based on the recent stock price of 23 cents.

If the 40-60 sales contribution pattern continues this year, the EPS would accordingly be higher.

3. Steady dividend payouts:

Teckwah has a track record of paying 0.8 cents a share in dividend each year – for at least the past five years (from 2004 to 2008). The yield is decent at 3.48% (based on 23-cent stock price), but not sizzling.

What's interesting is that there have been two unusual payouts:

a) For FY07, shareholders received a bumper 4.3 cents a share (wow!) as a special interim dividend and a 0.8 cent final dividend. The cash on hand at the end of 2007 was $23.3 million - far lower than the current $40 million.

b) This year, Teckwah paid a 0.8 cent interim dividend (when in previous years – except for FY 2007 - it paid nothing as interim dividend).

Will Teckwah pay a special dividend anytime soon? Wish we knew the answer ....

But we speculate that the chances are improved for a higher payout if the operating cashflow continues to be good in the second half and that cashflow bumps up the $40 million cash on hand (as of June 30) even further.

Negative:

1. The stock is illiquid with fewer than 50,000 shares changing hands on most of the trading days of this year. For many investors, this is a key negative as it impedes buying and selling meaningful quantities of the stock.

Investors who bought the stock six months ago would have doubled their money by now - from its low of 9.5 cents in March to 23 cents recently.

Your comments on the stock are welcomed.