With land at a premium in Germany, solar panels are mounted on rooftops, farmhouses, even on soccer stadiums and along the autobahn. Though dispersed across the countryside, they are connected to the national grid, and utility companies are required to pay even the smallest producers a premium of about 50 euro cents a kilowatt-hour.

- National Geographic , Sept 2009

Ken Wu, CFO, Anwell Technologies. Photo by Sim Kih

QUICK TO HARNESS the sun, Germany has transformed itself into the largest producer of solar power in the world, with a capacity of more than five gigawatts.

Halfway around the world, in China, the new production lines of Anwell Technologies are being finetuned to manufacture as many as a solar panel a minute for markets such as Germany.

Anwell, which is listed on the Singapore Exchange, has added the solar business to its portfolio, riding on the technologies that it has developed on the way to becoming the world’s No.2 manufacturer of equipment for manufacturing optical discs – such as CD-Roms and DVDs.

Anwell, which is headquartered in Hong Kong, has developed its own production lines for manufacturing solar panels, joining the ranks of only a handful of companies in the world with such a capability.

To be precise, there are only three others: Applied Materials (US), Oerlikon (Switzerland) and Ulvac (Japan).

Because Anwell not only designs and manufactures equipment but also manufactures the solar panels, its capex for equipment is much lower than all its competitors.

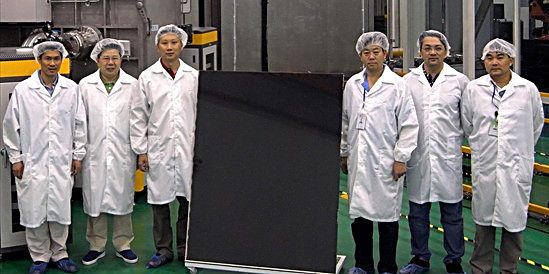

Anwell's solar plant in Henan is fully automatic. File photo by Leong Chan Teik

This is one of the competitive advantages of Anwell that its CFO, Ken Wu, highlighted during a series of meetings with analysts and fund managers in Singapore this week.

Being vertically integrated, Anwell pursues R&D which enables it to modify its equipment on the go for higher efficiency and quality – a privilege not available to competitors who buy equipment from third parties.

Anwell’s solar panels are of the thin-film variety, which delivers a lower cost per watt compared to conventional crystalline silicon panels. The latter are of mature technology which commands more than 90% of the market but is losing market share to thin-film technology which is superior technologically and has wider applications.

Ken said the market estimates are that thin-film panels could have a 50% share of the market in 10 years' time.

Starting in Q1 next year, sometime after Chinese New Year, Anwell will begin mass production from its 40 MW plant in Henan. The capacity will be ramped up to 120MW by the end of next year.

The solar business may be spun off in an IPO in three years’ time, said Ken.

Anwell's first solar panel. Chairman Franky Fan is third from left, with his top people.

Here are some highlights of the Q&A session that Ken had recently with analysts:

Q Will Anwell benefit from China’s ‘Golden Sun’ incentive programme announced two months ago?

Ken: If you invest in systems such as solar farms or construct buildings with thin-film windows, the government will give you 50-70% of the money. As a result, in the next few years, I expect there will be a lot of investment in solar in China. That will drive demand for solar panels, which is good for us.

Q China recently said it wants to curb the over-capacity of solar panel production. Does this apply only to crystalline silicon panels?

Ken: Yes, it doesn’t affect us. The supply chain for crystalline silicon involves many different types of players and it is easy to enter any of the business niches. So, in China, there are a lot of small companies in the crystalline silicon panel supply chain.

But for thin-film solar panels, the supply chain is short and, as you know, the capex is very high. Not many companies can raise that kind of money.

Q I read that Germany and other countries are cutting the subsidies for solar investments…

Ken: The incentives were set a few years ago, and are cut now because the costs of solar have gone down. In Australia, if you set up a 1 kilowatt solar system on your rooftop, the government would give you a A$8,000 rebate. Australia has recently revised this scheme. (See Australian media story here)

Q When do you guess that grid parity (the point at which solar electricity is equal to or cheaper than grid power) can be achieved?

Ken: It doesn’t really matter because the gap will continue to be filled by government subsidies. I don’t expect the subsidies to be stopped.

Q Is there a target that Anwell is raising the efficiency of its panels to?

Ken: We are doing R&D to improve the production process and we expect the efficiency level to be higher when we start mass production. At a higher efficiency level, each panel can generate more power and we can sell each panel at a higher price.

That is the only difference – the market price is set on a per watt basis, which currently is around US$2 per watt. I expect the price to drop next year but the production cost will also go down.

Q What’s the value of the recently announced contract by Anwell to supply 1.25 GW of panels to Solargen? (Delivery starts in 2011)

Ken: This will be according to the market price then. As it is a huge order, it will be delivered over three or four years.

Q When you start mass-production in Q1 next year, who would be your buyers? Is there a ready market?

Ken: Most buyers would be system integrators for solar farms in Europe and the US, who will set up the farms for investors. There is a ready market for the panels.

Q Why isn’t the China market taking off?

Ken: Because the Chinese policy was announced only two months ago, whereas in the US and Europe, they have been into solar energy for a few years already.

Recent stories:

ANWELL chairman: "From day 1, I knew we could be successful"

ANWELL produces its first solar panel

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors