WEE HUR Holdings is well known in the construction industry – it’s been in business for 30 years - but not so among investors, as its stock debuted on the Singapore Exchange only in January 2008.

That may be why, after attending a recent presentation by Wee Hur, a fund manager gave this written feedback: “Wee Hur surprised me with the impressive portfolio of developments it has constructed for its clients.

"Its tie-up with Ascendas certainly distinguishes itself from the normal plain vanilla construction peers.”

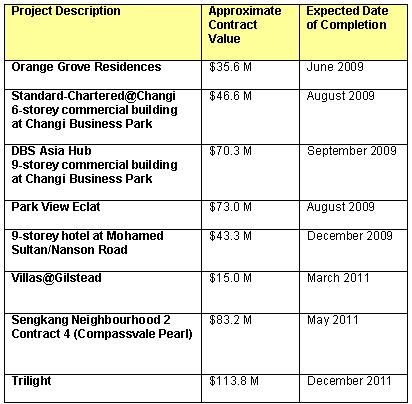

The current projects of Wee Hur are impressive too. Executive chairman Goh Yeow Lian highlighted the following at a roadshow organized by Financial PR last week for analysts and fund managers:

It's a good reflection of the stature of Wee Hur as a contractor that one of its projects is the Parkview Eclat, a super-luxury condominium on Grange Road. Units start at 3,000 sq ft and the penthouse tops at 10,000 sq ft. There are only 35 units in the 21-storey condominium - that's how exclusive and massive the units are.

Wee Hur is registered as an A1 contractor by the Building & Construction Authority, a grading that allows the company to tender for projects of unlimited size for public projects.

Interestingly, most of Wee Hur’s projects secured were through invited tenders – as opposed to open tenders. “That’s very important, especially during a downturn as there would be a limited number of bidders invited,” said Mr Goh.

Invited tenders are not confined to private projects: Wee Hur has secured public projects, such as the refurbishment of Old Parliament House, through invited tenders.

On Ascendas Group, Mr Goh said Wee Hur has a working relationship with Ascendas since 1994, and has a key role in shaping the bids of Ascendas for some projects.

Mr Goh touched on a new core business – property development. It’s all about getting in at the “correct pricing at the right time,” and the profit margin can be good, he said.

“We need to be cautious. But we are not new to property development and we have gone through a property cycle. As a contractor going into property development, it’s a plus point.”

Here are some of the questions from analysts and fund managers, and Mr Goh’s replies:

Q How are your gross margins from Ascendas as compared to other projects?

A Margins differ from project to project and depends on market sentiment. If a residential project can sell at higher prices, it doesn’t mean we will get higher margins.

Q You are going into property development. What will be your exposure?

A Because of our size, we can only undertake small or midsize projects. I’m looking at land value of not more than $50 million – for that kind of size, we can go in on our own. For bigger projects, we will team up with developers by taking a 20-30% stake. The important thing is, that will also create construction revenue for us.

Q You said management is not new to property development. Has the listed company done any property development?

A We have a private arm for property development. It has done 31 units of apartments opposite Holland Village. At present, the private arm has an ongoing project. We have given an undertaking that the private arm will not compete with the listco (Wee Hur Holdings)

Q Does the private arm have any land bank which the listco can take over?

A We are looking for new opportunities.

Q Can you give us an idea of your exposure to cost increases in building materials, overruns, etc?

A Under normal circumstances, once we have secured a job, we have to lock in prices, especially of essential materials such as concrete and steel. Last time, suppliers allowed us to lock in for the entire project but recently because of fluctuation in prices, we can lock in for a certain period only.

If we see the fluctuation is too high, we will request the developer to put in a fluctuation clause to protect us. If there is no fluctuation clause, we will benefit if material costs come down, as has happened with some of our projects. Most government projects have a fluctuation clause.

Q On the private side, are you involved in building materials?

A No. One good thing about us is we are very focused on construction.

Q In Q1, you had a turnover of $45 million and if I multiply by 4, you would be approaching $200 m turnover for the year. You order book at end of Q1 was $314 million. Can you give us an idea what you can look forward to in 2010?

A Of course, we need to replenish the order book – but that’s not a big problem.

Q Have payments by customers been prompt?

A They have been OK. You look at the list of our clients – they are very established.

For our recent story on Wee Hur's fascinating growth over the years, click: WEE HUR: Q1 profit up 525% on construction boom

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

WEE HUR eyeing growth via property development

- Details

- Leong Chan Teik

Mr Goh Yeow Lian (in blue shirt), presenting Wee Hur's story to analysts and fund managers. Photo by Sim Kih

L-R: $70.3 million DBS Asia Hub; $46.6 million Standard Chartered@Changi.

Current projects of Wee Hur

Mr Goh: Property development is all about buying at the right price and timing. Photo by Sim Kih

Wee Hur is trading above its IPO price of 25 cents.

You may also be interested in:

|

Why CGS Sweetened Food Empire's Target Price to S$4.00 |

|

NORDIC: After a long drought, 2 analyst initiation reports in 2 weeks for this company. What's up? |

|

The 100% Club: Which 58 S'pore Stocks Soared 100% or More in Past 52 Weeks? |

|

WEE HUR Q&A Highlights: Understanding This Company’s Growth from a Construction Business to a Broader Based Business |

|

More Than Just Construction: WEE HUR Continues to Evolve into a Multi-Asset Investor |

|

WEE HUR: "The market has yet to price in this multi-pronged growth story," says analyst initiation report |