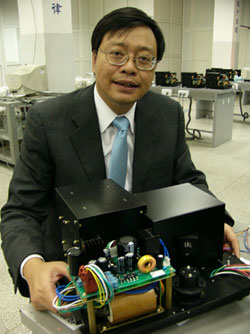

Techcomp's founder and president Richard Lo showing a part of Techcomp's analytical instruments, which can comprise of 3,000 to 4,000 precision components. Photo by Sim Kih

Techcomp's founder and president Richard Lo showing a part of Techcomp's analytical instruments, which can comprise of 3,000 to 4,000 precision components. Photo by Sim Kih

ANALYTICAL INSTRUMENTS for testing compounds present in the food & beverages, pharmaceuticals, chemicals, semi-conductors and petrochemicals that we use or consume daily are necessary in a myriad of industries.

These include the chromatographs, spectrophotometers and centrifuges distributed by SGX-listed Techcomp, which also designs and manufactures the analytical instruments.

Lab technicians and researchers rely on these instruments to separate, identify and quantify organic and chemical compounds.

Demand for analytical instruments is a component of R&D expenditure. As a proportion of GDP, China's R&D expenditure had increased steadily over the past five years at a high 8% average annual rate to reach 1.34% of 2005’s GDP pie.

It was a mere 0.9% in 2000.

China’s rise as a highly industrialized nation is driving demand for Techcomp’s advanced lab test systems, says its founder and president, Richard Lo.

Techcomp is China’s leading domestic manufacturer of advanced scientific instruments used in life sciences research and chemical analysis.

Advanced analytical instruments designed and produced by the company are sold under its proprietary Techcomp brand as well as under labels from world leading brands such as Hitachi Hi-Technologies.

China's strong demand for analytical instruments

From air and water pollution to energy conservation, China’s obsession with environmental standards is boosting its demand for analytical instruments.

For example, one of the numerous applications of a gas chromatograph is to monitor and analyze atmospheric gases – such as carbon dioxide, methane and nitrous oxide – in efforts to fight air pollution.

Between 2000 and 2005, China’s R&D expenditure as a proportion of GDP has rapidly emulated that of technologically advanced nations such as Japan (3.13%), Germany (2.49%), France (2.16%) and Korea (2.85%).

In Yuan terms, China’s R&D expenditure has grown a hefty 22% annually since 2000 to reach Rmb 245 billion in 2005, according to its Ministry of Science and Technology.

Growth in gross national R&D expenditure more than doubled its 10.3% average annual growth in manufacturing industries.

Consistent with industry growth, Techcomp's 1H07 revenues grew 22% y-o-y to US$25.6 million.

This year's growth was an extension of the company's strong showing over 2002-2006, when sales grew steadily at 24% per year, in line with China's growth in R&D expenditure.

Net profits tend to peak toward the year’s end, says Richard.

A significant portion of Chinese government funding for instrumentation is disbursed during the final quarter of the calendar year, giving rise to a seasonal trend in net profits of instrument makers who sell in China.

Techcomp’s first half net profits since listing in 2004 routinely contribute less than 20% to full year earnings. By the same token, 2H07 net profit is likely to exceed 1H07’s US$980,000.

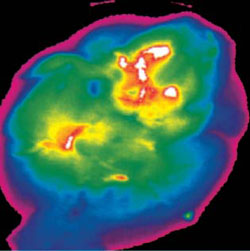

Techcomp’s chromatogram for white wine to rule breweries

Techcomp's proprietary gas chromatographs lead China's mid range analytical instrument market.

Techcomp's proprietary gas chromatographs lead China's mid range analytical instrument market.

Chinese brewers rely on one of Techcomp’s numerous proprietary instruments – an advanced chromatograph system – to prove that their samples match the fingerprint of ingredients common to authentic white wine.

“We developed the chromatogram that fingerprints authentic white wine, “ a well-pleased Richard says of his research team.

In 2005, China’s manufacturing quality watchdog body - the General Administration of Quality Supervision, Inspection and Quarantine – mandated safety guidelines for liquor brewed in China.

The Chinese watchdog wanted liquor makers to file chromatograph analyses on wine samples in exchange for “good manufacturing practice” (GMP) grading.

The ruling came after incidents of alcohol poisoning in 2004 linked to the consumption of inferior quality or toxic white liquor sparked widespread media attention.

Unregulated brewers sold counterfeit liquor containing industrial-grade alcohol or formaldehyde that were highly toxic or even fatal.

From this month, China will implement its GB/T10345-2007 standard for white wine authentication.

With inspection bureaus nationwide breathing down the necks of wine makers, Techcomp’s proprietary column with its white wine chromatogram is set to sell like hot cakes.

The national standard implies that all white wine makers need to purchase test equipment to certify that what they sell is fit for human consumption. Some 210,000 makers of various liquors were registered in China as at 30 June 2007.

Inspection bureaus will also need the test equipment to ascertain that white wine makers adhere to the standard.

Chromatography identifies the chemical make-up of a test sample by separating its elements.Chromatography identifies the chemical make-up of a test sample by separating its elements through a thin, circular tube called a “column”.

Chromatography identifies the chemical make-up of a test sample by separating its elements.Chromatography identifies the chemical make-up of a test sample by separating its elements through a thin, circular tube called a “column”.

Techcomp has only two competitors for its white wine authenticating gas chromatograph system: USA’s Agilent and Japan’s Shimadzu are the only two other makers qualified by China’s General Administration of Quality Supervision, Inspection and Quarantine.

‘Wine brewers and inspection bureaus won’t pay for imported brands to comply with regulation when they can buy our qualified test equipment at 30%-40% of Agilent or Shimadzu’s retail price,’ says Richard.

Chinese science equipment web site http://www.sciequip.com.cn/ shows Shimadzu retails at Rmb 72,000 to Rmb 188,000 per gas chromatograph.

Initial installation of testing systems contribute 53% to global analytical instrument demand, according to estimates by global leader in market research on the industry, Strategic Directions International. Equipment maintenance service contributes 13% while aftermarket consumables contribute 33%.

In comparison, Richard is expecting Techcomp’s consumables to contribute as high as 60% to sales in his chromatograph systems.

After all, Techcomp is in an enviable market position, having developed the lab test consumable (column to be precise) for fingerprinting of authentic white wine brewed in China.