|

ANOTHER YEAR HAS passed...and my CPF investment portfolio has turned up significantly.

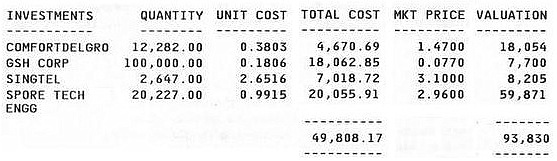

A year ago it stood at $93,830 as I shared in this article in June 2012:INVESTOR: How My Stocks Bought With CPF Savings Have Done (2012)

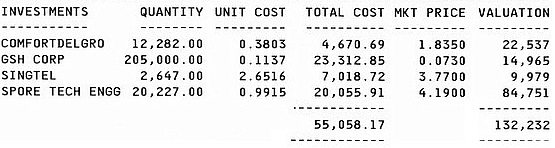

From $93,830 to $132,232, my portfolio has grown $38,402 as at end-June (see screenshot above).

Not all that is capital gain, as I had added $5,250 to subscribe for 105,000 rights shares of GSH just last month, ie June 2013, at 5 cents apiece.

Taking off the $5,250, I had a 35.3% capital gain in about one year. I couldn't be more happy with the performance.

And, by the way, the $132,232 doesn't include $4,652 of dividends from ComfortDelGro, SingTel and ST Engineering.

The dividends, which have been funnelled straight into my CPF Ordinary Account by my bank, translate into a yield of 14.7% on my historical cost (ie, $4,652 divided by $31,743)

In essence, my portfolio sang while I did nothing -- no trading at all, except for my subscription of the GSH rights which I was entitled to.

I had no reason to sell any stock in my portfolio as I judged ComfortDelGro and, especially, ST Engineering to stay resilient, and provide reasonable returns for many years to come. If they and SingTel just maintain their current dividend payouts, my dividend yield is already super rewarding at 14.7%.

I have no incentive to liquidate them and return the cash to my CPF Ordinary account to earn 2.5% p.a., nor am I motivated to look for other stocks. I guess that's what it means to stay in love and married with your stocks!

ST Engineering and Comfort DelGro have become four-baggers since I bought them some 10 years ago -- I can't recall the exact years. And that's not taking into account the annual dividends which surely would add up to a big chunk -- imagine 10 years x approximately $4,000 -- if I only bother to check out the exact dividend data on the SGX website.

As for GSH (formerly known as JEL Corp), thankfully, it is a come-back kid, sort of. It had nearly died on me a few years ago following a scandal but was rescued by popiah king Sam Goi this year.

As a result of my subscription of the rights shares of GSH last month, my unit cost has gone down substantially from 18.06 cents (table below) to just 11.37 cents (table above).

It's still in the red, but I have some hope that it will break even sooner rather than later as the company ventures into a new core business -- property development and construction in China, for which it had raised funds during the recent rights issue.

Through his subscription of his entitlement of rights shares, Sam Goi pumped in over S$100 million cash into the company. This portends well for the future of the business, in my view. In the next 12 months, I figure that once again I will let my CPF stocks do their hard work while I focus on living my life.

|

Screenshot of bank statement as at end-June 2013.

Screenshot of bank statement as at end-June 2013.  Screenshot of bank statement as at end-May 2012.

Screenshot of bank statement as at end-May 2012.