Excerpts from latest analyst reports….

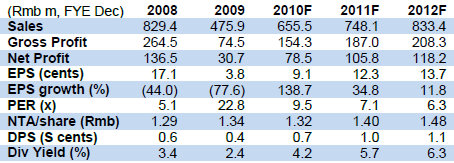

NRA Capital says FUXING’S acquisitions will ‘unlock cash value’

Analyst: Jacky Lee

Proposed acquisition of Rmb372m. After more than a year of discussion and negotiation, the group finally fixed the price of Rmb372m to acquire three companies which are mainly engaged in the dyeing and electroplating services. This will bring the group a big step closer to Fujian SBS Zipper (Xunxing), the largest zipper manufacturer in China.

Why acquire? Given the stringent PRC government policy relating to the environmental protection, dyeing and electroplating services are strictly regulated due to its pollutive nature. The group understands that the government will limit and restrict the issuance of new business licenses in the dyeing and electroplating services.

What impact? We believe the impact of the acquisitions will be positive. Fuxing will become the second zipper manufacturer with fully vertically-integrated capability in China after Xunxing. By capturing operational synergies arising from the value-added services, the company will be able to enhance its competitive advantage. Management believes the acquisitions are in line with their long-term growth strategy. This will make them operationally stronger, allow the group to capture viable revenue streams and expand its profit base.

What is the valuation? The group is paying about 10x historical FY09 PER or 4.1x PBR for the whole acquisitions. We view the valuation is reasonable as these dyeing and electroplating companies have been running at high utilisation rate since the onset of the financial crisis, mainly due to the stringent business licensing and less competition.

Maintain Buy. The acquisitions will be funded by the group’s cash reserves (Rmb636m net cash holding as at Sep-10). Net cash holding after acquisition will be more than rmb250m, which will still be sufficient for dividend payment as well as the capex expansion. The deal will not affect our FY10 estimates but we are reviewing our FY11 and FY12 forecast. We have kept our S$0.28 fair value for the time being, by pegging at 11xFY11 PER. Maintain our Buy call.

Recent story: FUXING: China’s No.2 zipper firm 2Q net nearly triples, 2010 looking good

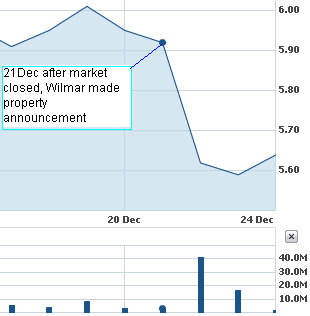

Goldman Sachs is neutral on WILMAR in its China property venture

Analyst: Patrick Tiah

News

On December 21, Wilmar announced that it has entered into a master joint venture (JV) agreement with Kerry Properties (China) and Shangri-La China to establish one or more JV companies for real estate development and management in Bayuquan, Yingkou City, Liaoning Province, China.

This agreement follows a successful bid for 3 sites in Bayuquan for RMB240mn (approximately US$36mn), designated for residential, commercial and hotel use. Wilmar’s investment for the project sites is approximately US$134mn, based on its 35% stake.

Wilmar and its JV partners are searching for other suitable sites in China and may jointly bid for such sites in the future.

Analysis

In our view, there are some synergies for Wilmar’s investments into property development in China, especially for the smaller 2nd and 3rd tier cities where Wilmar has operations.

In some cases, Wilmar’s investments may be a strong driver of economic development at these smaller cities (e.g. if it builds factories and ports), and Wilmar may also be able to leverage on its strong local knowledge and business networks to implement the development.

Some investors may also draw parallels with plantations companies in Malaysia, which have diversified into Property Development to create value from its low cost plantation land-bank (e.g. IOI Corp (IOIB.KL, RM5.80, Neutral, Dec 21: RM5.80)).

However, we believe that investors’ initial reaction may be negative – this appears to be a sharp departure from Wilmar’s agri-processing core business and there may be concerns on management losing focus.

Implications

We believe that the market may take this announcement negatively. No change to our earnings estimates, target price or Neutral rating.