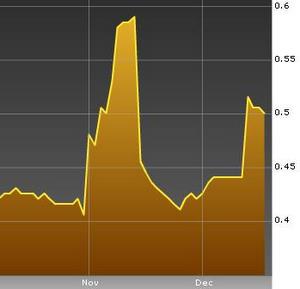

A special dividend caused the stock price to spike up in Nov. Will it happen again?

FOR MORE than three months (Aug-Oct), Hwa Hong Corporation shares traded between 40-45 cents.

Then came its announcement of its Q3 results on the night of Oct 30. At a time when companies normally don’t declare a dividend, Hwa Hong (www.hwahongcorp.com) surprised with one – and what a major payout it was.

12 cents a share!

The stock promptly reacted to the news by spiking to as high as 59 cents over the next few days.

The stock has gone ex-dividend, and went back to 41 cents until early last week.

This followed the Friday evening (Dec 11) announcement that Hwa Hong had entered into a non-binding Memorandum of Understanding with an unidentified purchaser.

Under the MOU, Hwa Hong will divest its 100% stake in Tenet Insurance for a whopping S$95 million cash.

The gain on disposal for Hwa Hong will be approximately S$43 million.

The $95-m cash sale is significant as the figure is about 29% of the $330 million market capitalization of the company (based on a recent stock price of 50.5 cents).

With the prospect of a delightful special dividend looming, the stock was back up to 50.5 cents recently.

|

Hwa Hong said in its announcement after the market closed on Friday, 11 Dec, that it has yet to determine the use of the proceeds from the proposed divestment.

”Such proceeds may be distributed to shareholders as dividend, utilised for working capital and/or invested in other assets or investments which may provide better returns to the Company and/or any other purpose.”

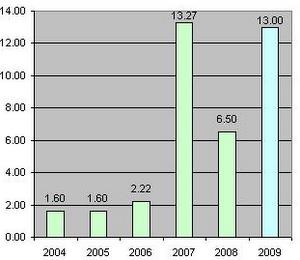

Hwa Hong's track record in paying dividends. Note that the 13 cents paid for FY09 does not include any final dividend payout that may be announced with the full-year results in Feb 2010.

Hwa Hong is an investment holding company.

Aside from general insurance, it has subsidiaries operating in warehouse rental, packing of edible oil products, general trading in consumer products, and property management and development activities.

It is one of the oldest listed companies on the Singapore Exchange - its IPO was in 1979.

Post your comments in our forum here.